Article Dean Dorton

Accounting Software

Business is booming. Your company is expanding, in what seems like no time at all.

Amidst the growth however, you’ve been noticing that it takes longer to close the books, that your team scrambles to mess with pivot tables and endless static excel spreadsheets to get answers today that you needed yesterday, and often, you can’t help but wonder how the competition is faring with their teams amidst their growth, too.

You know you that the right solutions for your company are out there. But, as you stand in the dark with new problems and demands as a result of growth, you may not know just what solutions will best address them because your priorities look so different from even just a few years ago when your company was preparing for growth.

It wasn’t all that long ago when financial teams considered it more prudent to stick with tried-and-true systems in order to avoid risk, but now, with the advent of ever-changing technology, we are in a different age, and those same belief systems applied to an information-based market no longer apply.

In today’s market, to provide the best, most-up-to-date service, your business systems not only need to satisfy customers and compete with other industry leaders in your market but also must live up to your standards to offer fast, detailed, accurate information to make the most informed decisions needed to manage growth.

Yet with so many variables, it can be difficult for companies to make an informed decision as they aim to modernize their outdated systems. Making matters worse, many companies opt to stick to their current systems for fear of making an unwise tech decision for their company.

But playing it safe can be placing their businesses at risk in more ways than they might think.

According to Saugatuck Tech, 90% of all businesses are applying some cloud-related tech to change, improve and innovate their businesses.

GET THE FACTS

Just because you are entering into unexplored territory doesn’t mean that you have to push ahead uninformed.

We know the risks and we find solutions for companies that are blazing trails in their technical fields. We know what the most tech-savvy businesses face as they grow.

“Finance at a Crossroads – The Risks of Standing Still” offers expert advice and risk factors involved in your company’s response to growth during this critical time of change for your business.

If you’re at a crossroads, switching to Sage Intacct-a best-in-class cloud accounting solution, can boost your business to be the best version of itself that it can be.

- Expanded document approval capabilities. Previously, Intacct Employee users only had the capability to approve Purchase Requisitions. With Intacct’s 2017 Release 3 (effective August 18th), Employee users will now be able to approve Purchase Orders and Invoices. These changes provide the following new functionality:

- Different approval work flows for different transaction types: Purchase Requisitions, Purchase Orders, and Invoices can each have their own approval process defined, based on the approval needs. For instance, Requisition approvals may be delegated to an employee manager level, so that approval requests to higher level management personnel is reduced. If the Requisition passes the employee manager level, and is then converted to a Purchase Order, management can then approve the Purchase Order. Note: for those organizations that do not want to use Purchase Order Requisitions, they can keep the functionality of Employee user approvals by using a Purchase Requisition document relabeled as a Purchase Order.

- PO Invoice approval – Previously, PO Invoices could not be assigned an approval process. When Purchase Orders were converted into a PO Invoices, there was no approval oversight before posting. With Invoice approvals available in Intacct’s 2017 Release 3, those people most familiar with the transaction (i.e. employees, managers, department heads) can be assigned the task of electronically approving an invoice. Gone are the days of managers manually signing off on paper documents! The same functionality for increasing levels of value and tiered approvals can also be applied to PO Invoice approvals. An audit trail of each approval is maintained within Intacct.

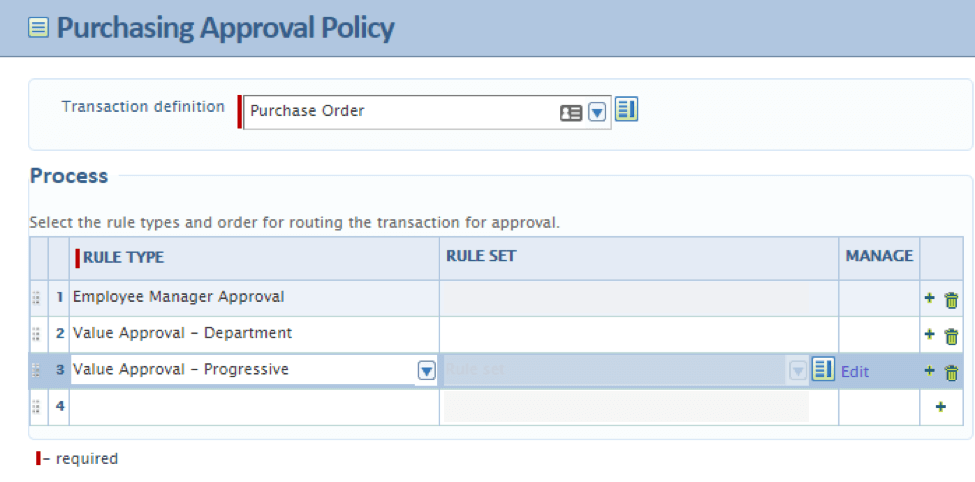

- Redesigned Approval Setup – with Intacct 2017 Release 2 the Approval Setup screen has been changed to provide a more graphical representation of the Approval Process. Located in the Purchase Order / Setup / Purchasing Approval Policies page, users are presented with a grid of approval steps for each transaction type – Purchase Requisition, Purchase Order, and Invoices (below).

Dealing with change is standard operating procedure for many companies: employees leave and are hired; new products are introduced and old ones phased out; there are booms, and there are busts. On top of all that, companies need to account for sales and use tax changes. Significant changes in rates, regulations, and product taxability often take effect July 1, which is the start of a new fiscal year in all but a few states.

At the end of 2016, we shared many of the sales tax changes set to occur January 1, 2017. These included state sales tax rate changes in California and New Jersey, the expansion of sales tax to certain services in North Carolina, the prohibition of taxing more services in Missouri, and a bevy of recently enacted soda taxes and tampon tax exemptions. At mid-year, we’re seeing a few propositions that signify a dramatic shift in online sales tax revenue.

States want to collect more tax revenue from remote sales

Perhaps the most notable trend of 2017 is states’ push to obtain tax revenue from remote sales. This isn’t new. States have been working to tax out-of-state sellers for years, but their efforts have been hampered by Quill Corp. v. North Dakota, 504 U.S. 298 (1992) — the landmark Supreme Court ruling that a state can only tax businesses physically located within its borders.

In recent years, states have found creative ways to work around the physical presence precedent upheld by Quill. They’re taxing businesses with ties to in-state affiliates and those that generate a certain amount of business through links on in-state websites (commonly known as click-through nexus). Increasingly, they’re also taxing companies with a certain amount of economic activity in the state (economic nexus). Unfortunately for states in need of additional sales tax revenue, these affiliate, click-through, and economic nexus laws are difficult for states to enforce.

Therefore, many states are looking to different and more aggressive approaches. Two methods, in particular, have been gaining steam this year: use tax notification and reporting requirements, and taxes on online marketplace providers such as Amazon and eBay.

Use tax notification and reporting requirements

Colorado paved the way for states to impose use tax notification and reporting requirements on non-collecting out-of-state sellers. After spending years stuck in court, its policy takes effect July 1 — the same date a similar policy starts in Puerto Rico. Vermont recently passed one and made it effective retroactively, on January 1, 2017. Other states, including Pennsylvania and Texas, are considering use tax notification and reporting measures.

Sending annual reports of consumer purchase activity to consumers and state tax authorities is more work for remote retailers, and Colorado and the other states could be using their policies as a back-door approach to getting out-of-state companies to register and collect. Even if companies choose to not take that route, use tax reporting should help states increase their use tax collections.

Taxing online marketplaces

Minnesota is the first state to enact a tax on marketplace providers. HF 1 will take effect at the earlier of July 1, 2019, or when the Supreme Court modifies its decision in Quill — though the effective date could change if Congress passes legislation allowing states to tax remote sales.

North Carolina, Texas, Washington, and a number of other states are also interested in taxing marketplace providers, and their efforts are likely to continue or resume as 2017 wanes. But not all agree it’s a good idea: New York lawmakers blocked Governor Andrew Cuomo’s attempt to tax them earlier this year.

Congress could tackle online sales tax

Federal lawmakers are much preoccupied with tax reform and repealing or revamping the Affordable Care Act. Allowing states to tax remote sales transactions, or definitively preventing them from doing so, seems to be low on their list of priorities. However, we’ve learned to expect the unexpected from Washington, so a federal solution to the problem of untaxed remote sales should not be entirely ruled out.

Two bills have been introduced that would authorize states to tax certain interstate sales: the Marketplace Fairness Act of 2017 and the Remote Transactions Parity Act of 2017.

A bill that would codify the physical presence standard set by Quill and further limit states’ ability to tax interstate sales has also been introduced: the No Representation Without Representation Act of 2017.

Other sales tax changes

Many of the trends seen at the start of the year are continuing as 2017 progresses. Florida has enacted a tampon tax exemption, Seattle a soda tax. Tennessee is lowering the state sales tax rate on food and food ingredients, there are calls to add a statewide sales tax in Alaska, and although he failed to achieve it this session, Governor Jim Justice has been pushing to raise the state sales tax rate in West Virginia. The taxation of services — including online music and movie streaming services — remains a hot and hotly contested topic. And, as always, a plethora of local sales tax rate changes take effect at the start of each new quarter.

Don’t be lulled into complacency during the dog days of summer: There’s a lot happening in the world of sales tax right now. Staying on top of these and other changes will allow you to prepare for them. Download Avalara’s 2017 Sales Tax

Changes Mid-Year Update to learn more.