Sage Intacct users: have you ever needed to present two different sets of numbers depending on the audience? No, we are not advocating for anything misleading or nefarious. Think about the different stakeholders that you need to present financial reporting to. You’ve got your auditors, who want to see your GAAP financial statements. You’ve got your tax professionals, who are interested in tax basis. You have department managers, who are in need of detailed budget versus actual reporting. The business owners probably want to see a host of different reports including cash results, profitability forecasts, and maybe even a view of what your company has committed to spending but not actually spent yet. Maybe you, as the accounting and finance professional, want to create “what if” scenarios or to be able to show a report with the before and after the impact of a transaction. If you have these kinds of needs right now (in today’s environment, who doesn’t?), you may find yourself back to your trusty old friends Excel or Google Sheets. There is a better way that comes at no additional cost – Sage Intacct User-Defined Books.

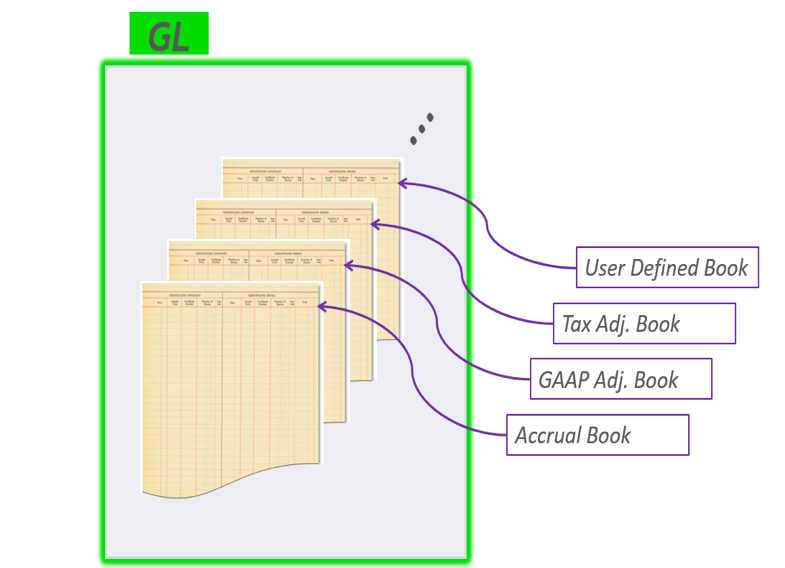

Sage Intacct, as an accounting system, has unique architecture. It is built on a “multi-book” concept. If you have used Dynamic Allocations, Contracts, or Global Consolidations, you have already worked with the “multi-book” architecture and you already have experience with User-Defined Books. The below graphic illustrates this concept:

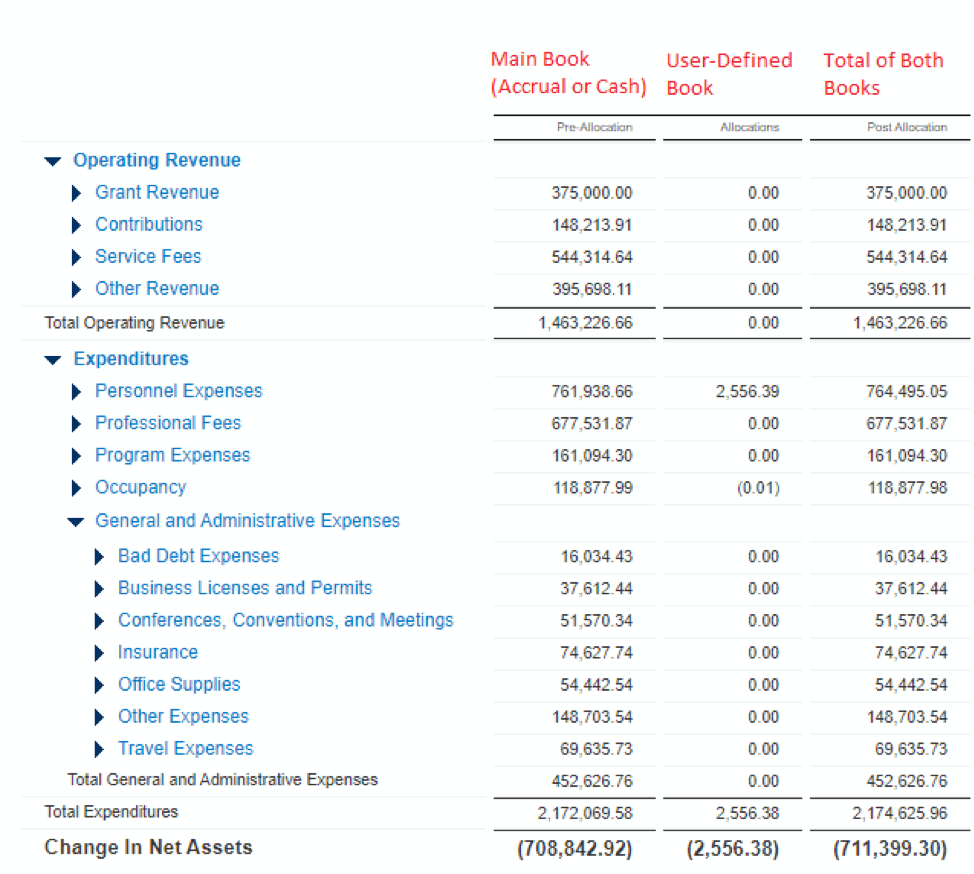

The power of this concept comes into play when you use what we like to refer to as “book stacking.” When you stack one book on top of the next, your result is the cumulative effect of entries within ALL the books. In Sage Intacct, you have the flexibility in financial reports to display all books stacked on top of each other or to display your Accrual (or Cash) book and your user-defined book(s) in separate columns. This affords you an incredible amount of flexibility in creating financial statement presentations for different audiences. Here’s an example of a before and after the allocation statement: you can do the same thing with before and after tax, with and without commitments, hypothetical transactions, etc:

The best part about this for accounting and finance professionals is that everything lives inside your Sage Intacct environment. When you are starting from your system of record, your constant risk of an offline schedule being out of date vanishes. User-Defined books are a tremendous opportunity for efficiency, and in many cases the limit of what you can do is only your creativity! Dean Dorton has a wealth of experience in using and implementing this feature for clients across all industries.