The Tax Foundation, a non-partisan, non-profit organization, issued findings that a large source of tax revenues for most countries, including the U.S., comes from taxes on wage income through individual income taxes and payroll taxes. For U.S. workers, the burden is approximately one-third of the average worker’s income. A few significant key findings are as follows:

- U.S. wage earners face two major taxes: individual income taxes and payroll taxes (levied on both the employer and employee.) Although the employer bears the burden of more than half of payroll taxes, workers ultimately receive the burden through lower take-home pay.

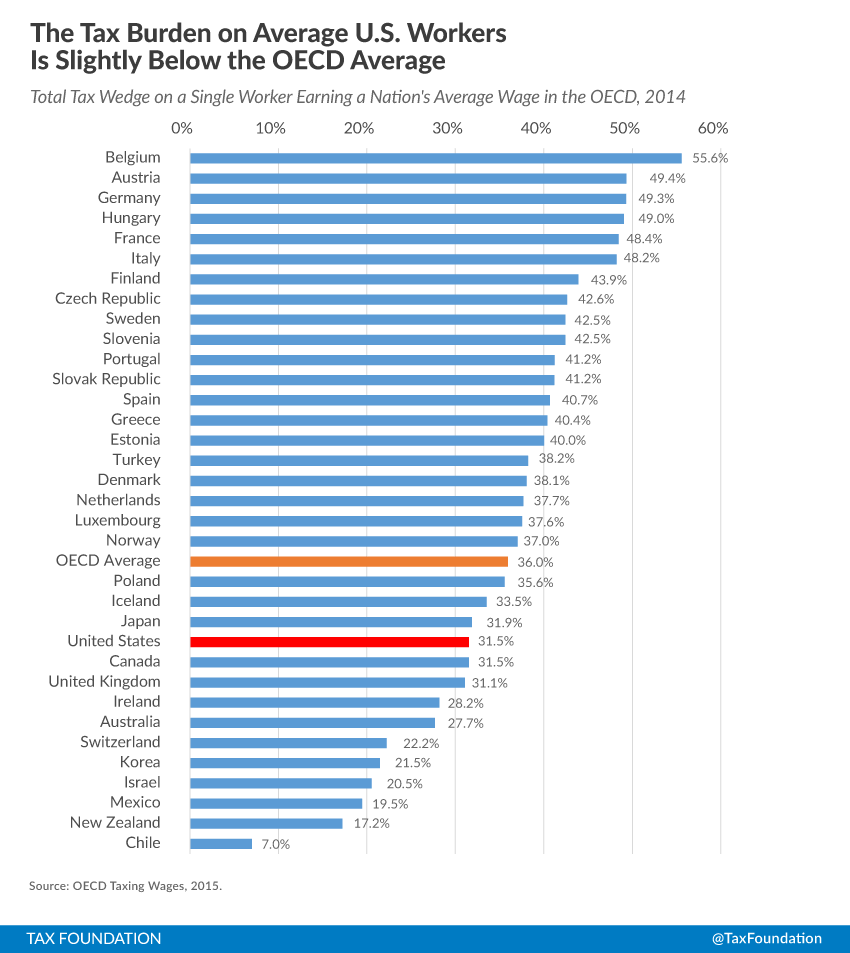

- The total tax burden on U.S. wage earners is 31.5% of their pre-tax earnings, which is less than the 34-country average of 36%.

- In the absence of income and payroll taxes and the benefits they provide, the average worker would take home nearly $5,000 in additional annual income.

Below is a chart from the Tax Foundation’s report showing how the tax burden on wage earners in the U.S. compares to other Organization for Economic Co-operation and Development (OECD) countries.

Although the tax revenues collected are used to fund various government programs, the Tax Foundation’s article details what the cost of these programs are to the average U.S. wage earner. For more information, please read the Tax Foundation’s full report.

If you would like to discuss the article, please contact Allison Carter at 859-425-7645 or alcarter@deandorton.com.