It’s been almost two years now since the FASB issued Accounting Standards Update (ASU) 2020-07, Not-for-Profits Entities (Topic 958): Presentation and Disclosures by Not-for-Profit Entities for Contributed Nonfinancial Assets, also referred to regularly as in-kind gifts. This update does not change how organizations recognize contributed nonfinancial assets, but how they are presented. According to FASB Board Member, Sue Cosper, the ASU addresses concerns of nonprofit stakeholders “by requiring more prominent presentation of contributed nonfinancial assets and enhanced disclosures about the valuation of those contributions and their use in programs and other activities, including any donor-imposed restricted on such use.”

There were a few issues that arose in 2018 that moved this standard forward for FASB. The primary concern among officials specifically related to how donated pharmaceuticals, received as in-kind gifts, were being recognized based on wholesale market prices that potentially inflated the revenues and program expenses for some nonprofit organizations. The inflated revenue and expenses of these gifts would ultimately make those nonprofits appear larger than those with smaller resources and lower value in-kind gifts.

With the new ASU, in-kind gifts are no longer able to be presented among cash contributions or other financial assets on the statement of activities. The in-kind gifts are now required to be separated and presented independent of cash or financial asset contributions. The new standard also requires additional disclosures to the financial statements showing which programs or activities these in-kind gifts benefits or are used to further. In-kind gifts include fixed assets such as land, buildings, and equipment, supplies and materials which could include food, clothing, toiletries, printed materials, or even contributed services.

In-kind gifts should be considered when special events are being planned. Was the venue for a gala donated? Did a local celebrity donate their time to MC the event? Were there silent auction items donated? All donations monetary or in-kind should be logged and tracked within the organization to make sure all reporting is completed and no donations fall through the cracks.

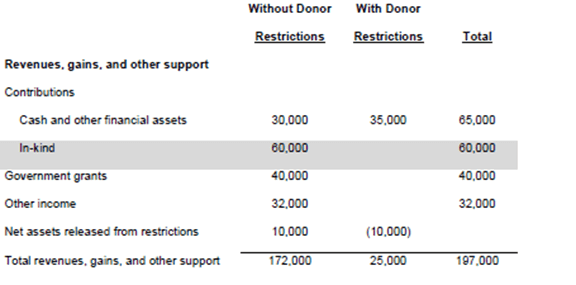

Organizations have a couple different options when it comes to presenting the in-Kind contributions on the face of the statement of activities. The first option is presenting contributions with subcategories of cash and other financial assets and in-kind as such:

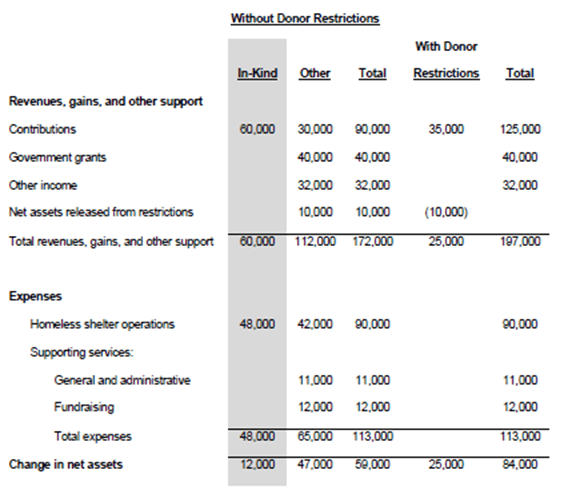

The second option is the use of a separate column, presented as follows, and provides the use of in-kind gifts based on expense classification.

Either presentation is acceptable but, keep in mind, the column approach provides additional information related to the expenses of the in-kind gifts and is required with this presentation. When using the separate row in the first example, it is not required to report the expenses related to the in-kind gifts. Although some organizations may not want to present the additional expense information, the column approach may be more beneficial to the organization and readers of the financial statements.

The disclosure requirements related to in-kind gifts have substantially increased with the new standard. Nonprofits are required to disclose a breakout of the amount of in-kind gifts recognized within the statement of activities by category that best depicts the type of in-kind gift. The categories are based on the specific needs of each organization and can be as broad as clothing or food. Each category of in-kind gifts recognized should also have a disclosure of qualitative information about the in-kind gift and if they were either monetized or used during the reporting period. The organization’s policy related to monetizing rather than used should be part of the policy disclosures. If the gifts were used during the period, a description of the programs and activities in which those assets were used is required. Any donor restrictions should be disclosed in relation to in-kind gifts following the organization policy around donor restrictions. Finally, any valuation techniques or inputs used to determine fair value measurement, in accordance with the requirements in FASB ASC 820, Fair Value Measurement, need to be disclosed.

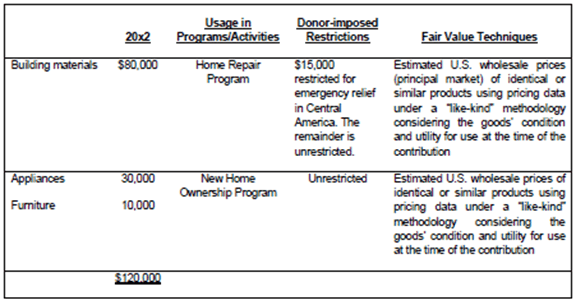

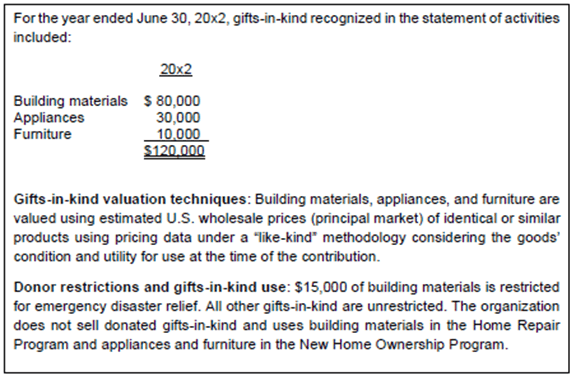

These disclosures can be accomplished in a couple different ways. The organization could use a chart or narrative form within the disclosures as follows:

Chart:

Narrative:

It is important to note, many of the above disclosure requirements are already in place for contributed services even though this new standard does include contributed services. FASB ASC 958-605 Not-for-Profit Entities: Revenue Recognition, requires contributed services disclosures include the programs or activities the services were used for along with the extent those services were received and recognized during the period. Keep in mind, there are requirements to recognize contributed services and they must create or enhance a nonfinancial asset and require a specialized skill be provided that would have otherwise been required to be purchased if not contributed.

ASU 2020-07 is effective for the annual period beginning after June 15, 2021 (i.e June 30, 2022), and interim periods within annual periods beginning after June 15, 2022. Early adoption is permitted, and the standard should be applied retrospectively. As nonprofits begin to look at this new standard, they should be aware of the level of in-kind gifts and services they receive. Subsequently, they should determine if their nonfinancial contributions are material to their financial statements as a whole and, if said nonfinancial contributions were not disclosure or not separately presented within the statement of activities, would the Organization be materially misstating the financial statement to the readers.