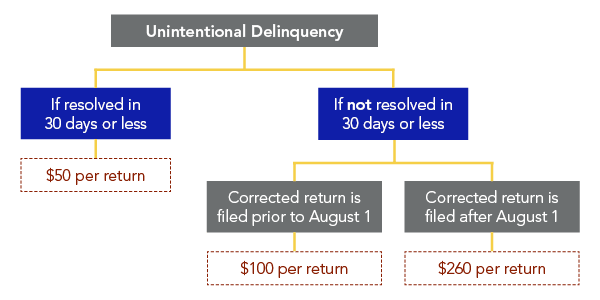

Penalties for failure to file correct information returns (e.g. W-2s, 1099s, 1098s, 1042s) are subject to annual inflationary increases per Section 208 of Public Law 113-295. These penalties are based on the period of delinquency, the intent, and the size of the taxpayer. The maximum penalties vary based on the size of the business and the amount of time that the return was late.

If there is intentional disregard, then there is no limitation.

With the recent change in filing deadlines for 1099-MISC (non-employee compensation) and W-2 forms to January 31, businesses will need to be diligent in meeting the new due date or possibly be assessed the aforementioned penalties. To avoid penalties for incorrect information or late filings:

- Obtain a completed and signed W-9 from any vendor prior to payment.

- Obtain social security numbers and home addresses from each employee prior to their first payroll.

- Use the IRS TIN (tax identification number) matching system to avoid incorrect tax identification numbers.

- To ensure you are meeting all specified IRS deadlines, refer to the IRS website and form instructions or hire a qualified professional to generate the required forms.

For further information or if you have any questions, please contact your Dean Dorton advisor or Gina Whitis at gwhitis@deandorton.com.