This blog is the March Edition of our CFO Minute: A Sage Intacct ERP Series.

INVASION OF THE AUDIT SNATCHERS– Let’s face it. The idea of an audit can be easier in theory than in practice. For nonprofit organizations, the greater the competition for funding, the greater the increase in audit scrutiny- and your organization should be prepared.

The overall goal is to earn a “clean” unqualified opinion from your auditor. With this being said, the key to audit readiness is keeping up with well-documented transactions and balances.

Why Do Audits Matter to Nonprofits? (or at least they should!)

Public Record & Transparency: The push for complete transparency in the nonprofit space is stronger than ever- potential donors, grantors, and government authorities can look to public resources such as GuideStar to review a nonprofit’s audited financials. Keep in mind that the data that donors and stakeholders see can impact their charitable decisions in the future.

Grant Requirements: What nonprofit DOESN’T want to be eligible for grants?! A clean, audit-ready financial statement can make or break the decisions of grantors. Many grants require submission of audited financial statements as part of the grant application process- so make sure you are appropriately tackling that, along with the due diligence process.

Accounting Standard Changes: Surprise! Did you know that all nonprofit organizations are now in the time period where implementation IS A MUST? What does this mean? Ensuring compliance with state and federal guidelines from an audit perspective is absolutely necessary in order to get an unmodified audit opinion, especially considering that FASB now recognized that nonprofits are “different” than other organizations.

Reporting Submission Deadlines: Granting organizations, especially government organizations, offer virtually no flexibility on submission deadlines for a complete application and all of its attachments- one of those is most likely to be your audited financials. Avoid having your finance team scrambling around in the office to pull together all your nonprofit financial data.

Don’t Kill Your Reputation

The best thing your nonprofit can do if the audit snatchers come is BE PREPARED. Your organization’s finance team is responsible for the preparation and fair representation of its financial statements, including implementation aspects and making sure all financial data is free from material misstatement- whether due to fraud or error.

Ensuring a clean, error-free audit-ready financial statement is critical when it comes to your nonprofit’s reputation. Overall, you need to be able to show what exactly your nonprofit is doing, how you’re doing it, and what your impact is as you pursue your mission.

How Can Sage Intacct Help?

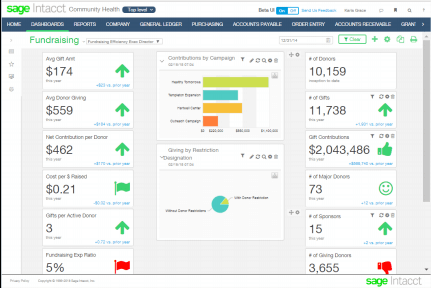

Tired of QuickBooks or that 10-year old accounting system that definitely isn’t scaling while your nonprofit is? Learn how Sage Intacct, the leader in cloud-based financial management, is helping nonprofits- big and small- automate their tracking for funds, donors, and grants, along with helping organizations pull accurate audit-ready financial statements in just a few clicks!

Tired of QuickBooks or that 10-year old accounting system that definitely isn’t scaling while your nonprofit is? Learn how Sage Intacct, the leader in cloud-based financial management, is helping nonprofits- big and small- automate their tracking for funds, donors, and grants, along with helping organizations pull accurate audit-ready financial statements in just a few clicks!

Want further clarification on the information above or want to learn how Dean Dorton can help your nonprofit when it comes to financial management? Contact us!

In the Meantime…Check out the Meals on Wheels Case Study!

You’ve probably heard of Meals on Wheels… a unique and well-known nonprofit helping communities all across America. Check out their case study and how Sage Intacct helped them cut audit preparation time by 60%. (Fun fact: Don Miller, our March CFO Minute participant, was previously the CFO at Meals on Wheels!)