Desiring to begin to transform care delivery in their practice, Lakeside Specialists* located in the Southern United States, implemented an advanced focus on consistent and appropriate diagnosis coding analysis to develop a measurable state of their Risk Adjustment Factor Scores (RAF).

*Lakeside Specialists is a pseudonym used to protect the client’s name and identity for this case study.

THE CHALLENGE

Medicare Advantage (MA) is poised to grow at a rate of 10-12%, representing market penetration of more than 46%. Senior healthcare consumers have found lower cost patient to provider entry, Part D coverage, and expanded plan benefits to be strong enrollment attractors.

Medicare Advantage is administered by insurance plans under an arrangement with CMS. Many newer members, aging into MA eligibility, have more experience with commercial managed care thereby making MA plan selection attractive to the senior population many specialty practices serve.

Medicare Advantage offers improved contract customization through various incentive and payment structures with ranges of tolerable risk entry. Medicare Advantage reduces patient identification challenges and can streamline custom cost target development. Medicare Advantage is driving the shift to value and will reverse the trend of slowing value adoption.

The Solution

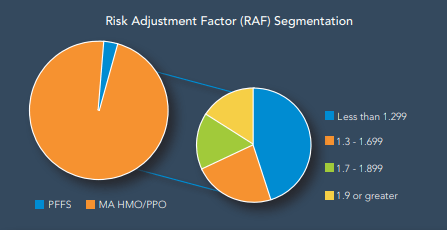

The initial project was intentionally limited to one payer group, but positive results drive encouragement toward a larger practice initiative. Demonstrated risk adjustment optimization, applied to clinical pathways and patient experience, created a model platform for payer planning discussion that permitted the practice to implement and succeed in Medicare Advantage payer contracting.

Results

- Advanced practice focus on consistent and appropriate diagnosis coding

- Established the introductory pathway to shared savings and value payment application

- Strengthened Medicare Advantage reimbursement expansion

in reimbursement and practice readiness to drive migration into value-based care