Written by Barbara Raess, Sage Intacct Consultant at Massey Consulting

You have done your due diligence to complete budgeting for your company. You have held working sessions with the management team for each department/location over the last several months about your business goals and creating next year’s budget. The sales team has presented their revenue estimates. Each manager has come to you with their wish list of expenditures they believe are needed to be successful in the coming year. You have diligently worked with all involved to present a budget that has been accepted by the Company Executives and the Board of Directors.

Now, how do you get the information into Sage Intacct in a timely and accurate manner? Lucky for you, we’ve outlined the steps to efficiently keying in your financial planning so you can enjoy Sage Intacct’s pre-built functionality without the time-consuming search for how to get it done quickly.

A) Create your Budget ID and Name. Keep it simple. Think of the Budget ID and Name as a container, not the data in the container used on financial reports. Creating a budget called “Operating” or “Annual” will allow you to add multiple years to a Budget ID and Name, thus eliminating the need to update the budget column on financial reports year over year.

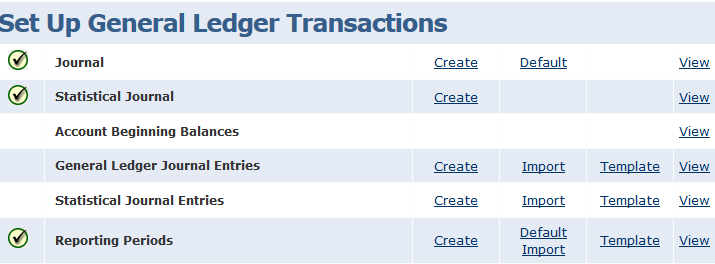

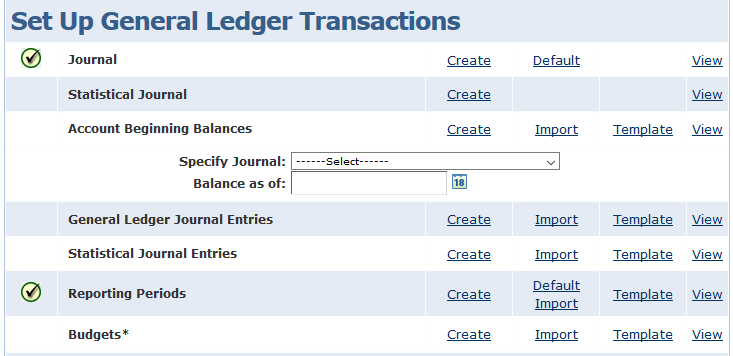

B) Next, create your reporting periods: There are three ways to add reporting periods in Sage Intacct. (Companies using custom accounting periods will need to add new accounting periods via Company >> Accounting periods setup)

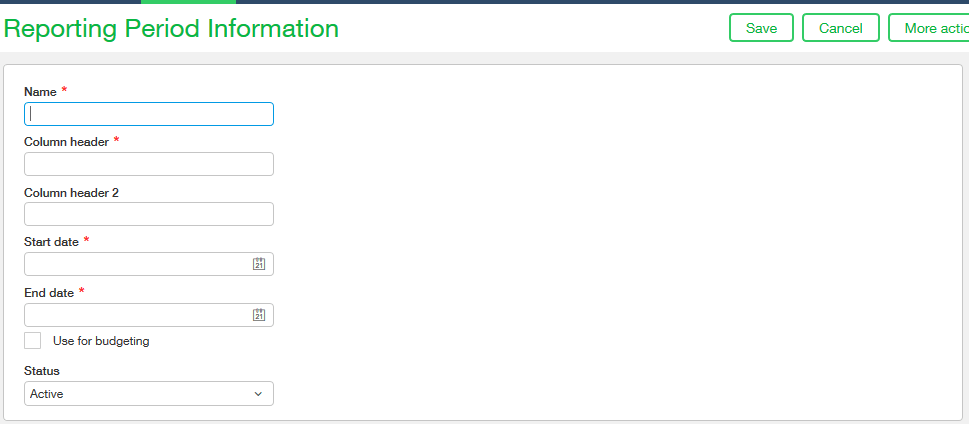

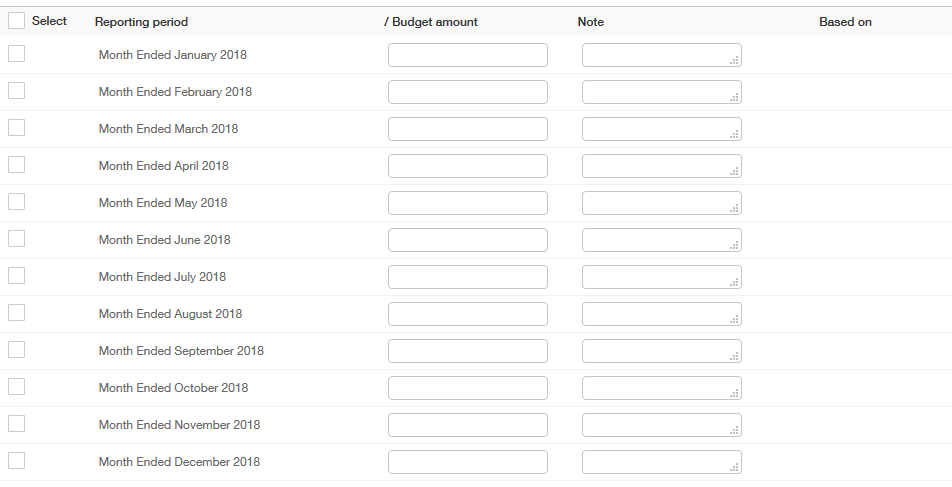

- Manually – you will need to create a reporting period for each period on your budget. Make sure to check the box next to “Use for budgeting.”

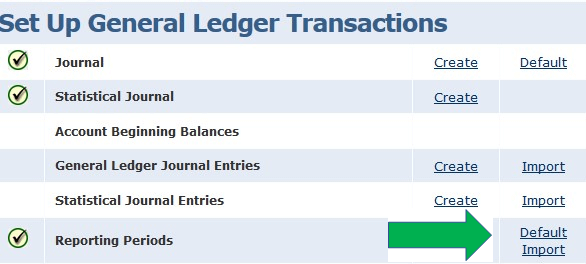

2. Import via a template from the import company setup

3. “Default Import” from the import company setup. Sage Intacct will look at the reporting periods in the system and determine if prior year periods, current year periods or future year periods are needed. If only future year periods are needed, Intacct will create only future periods.

C. Finally, add your Budget data. You have two options for adding your budget data:

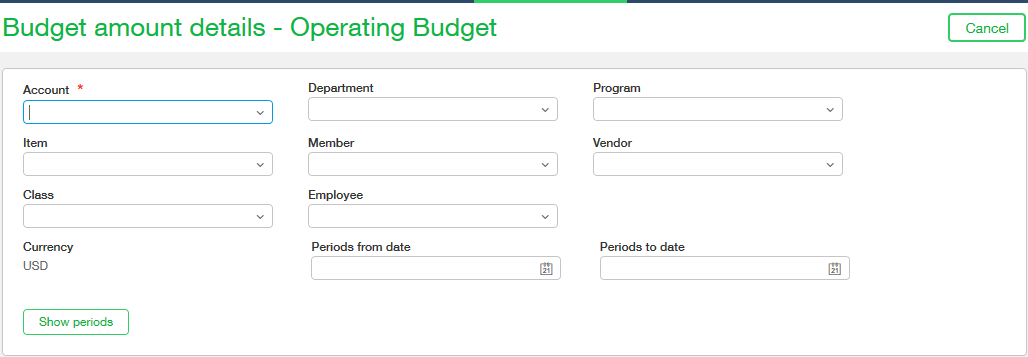

- Manually is best used with small data sets

2. Import your data using the budget template. There are two options for obtaining the budget template.

a) Download the template from “import company data”. If you are using the template from “import company data”, you will be required to input the reporting periods for your budget. The template inserts “Budgetable Period” in the column header.

Budget Template Example:

| DONOTIMPORT | BUDGET_ID | ACCT_NO | DEPT_ID | LOCATION_ID | (BUDGETABLE PERIOD1) | (BUDGETABLE PERIOD2) |

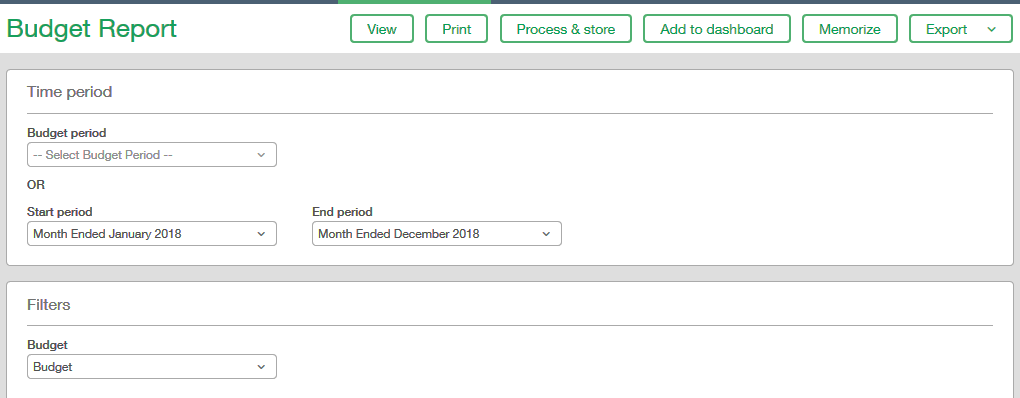

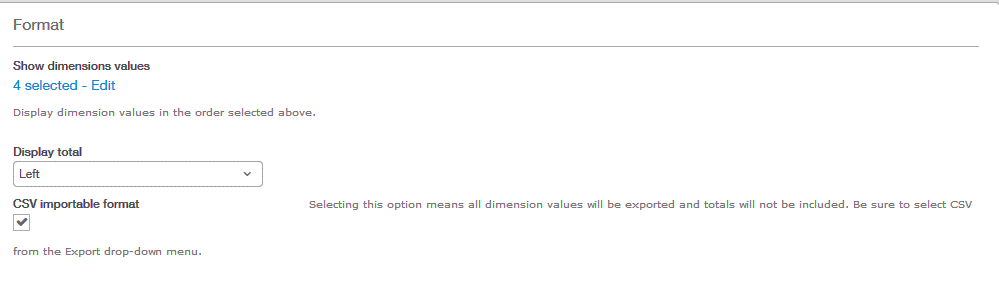

b. Download the template by creating a budget report. Entering the budget start and end periods and exporting as a csv importable format from the budget report will create a budget template with the reporting periods already added.

Example of a Budget template created using the budget report:

| BUDGET_ID | ACCT_NO | DEPT_ID | LOCATION_ID | Month Ended January 2018 | Month Ended February 2018 |

As always, if you ever need help with something in Sage Intacct, check out our learning and training opportunities!