Dean Dorton Event in Raleigh, North Carolina: Audit-Ready Financials for the Modern Nonprofit CFO

Independent external audits of GAAP financial statements are an inescapable reality—especially for nonprofits who face increasingly stringent scrutiny by individual donors, grant-making foundations or corporations, and even government regulators.

Creating audit-ready financials is easier in theory than in practice, however, because the audit process often quickly bogs down in down in the reconciling and tracing of numbers through the accounting system because the accounting is not well-organized and documented. Thus, the auditor spends far too many hours understanding relatively mundane accounting issues and verifying data flows. Typically, financial statement audits get derailed by accounting and documentation deficiencies in three major areas: revenue, receivables, and consolidation.

Challenge 1: Revenue recognition

GAAP-compliant accounting is a top challenge for finance professionals because the loosely defined regulations and evolving interpretations create a high level of complexity. In many instances, the timing of revenue recognition receives the greatest level of scrutiny—and nonprofits are not exempt. According to MorganFranklin Consulting, “Many ways that nonprofits generate income are considered revenue from contracts with customers and are subject to the new revenue standard.”

One of the best ways to be audit-ready for revenue recognition is to rely on an accounting system with a proven track record of automating, managing, and documenting complex revenue accounting. The software should define separate revenue recognition templates and rules for each individual contract and line item, enabling you to easily defer recognition based on the fulfillment status for each item.

Challenge 2: Accounts receivable

Nonprofits typically have two kinds of receivables: trade receivables, which is money that clients of the organization owe for receiving services; and pledges and grants receivables, which are future gift commitments by donors, foundations, and other grantors. Auditors care about the realizable value of your receivables, which requires an accounting judgment to calculate an allowance for uncollectible accounts. Your accounting software should track transaction details forever and maintain secure access to complete customer histories so that your judgment of collectability is well-founded and defensible.

Challenge 3: Consolidation

Organizations that report a single consolidated set of financial statements for multiple entities are at a greater risk of a misstatement because of the complexity involved in identifying and properly accounting for all of the intercompany transactions and eliminations. Most finance departments manage consolidations using a massive, complex spreadsheet workbook. Yet, any experienced auditor will tell you: these spreadsheets contain formula errors, lack some GL accounts, or are impossible for the auditor to untangle and follow.

The best way to get audit-ready is to automate financial consolidations with completeness and accuracy. Automation reduces the chances of human error when dealing with this high volume of data and calculations, which reduces your overall risk of a material misstatement.

Get audit-ready with the right fund accounting software

In addition to streamlining and automating your daily accounting and period-ending financial closes, the right software platform also makes life easier for your auditor. Automation removes the risk of manual spreadsheet errors, makes your calculations faster and more reliable, and reduces the time the auditor spends rechecking your accounting calculations. And an accounting system that is purpose-built to manage and demonstrate the accounting path sets the stage for you and your auditor to have a positive audit experience.

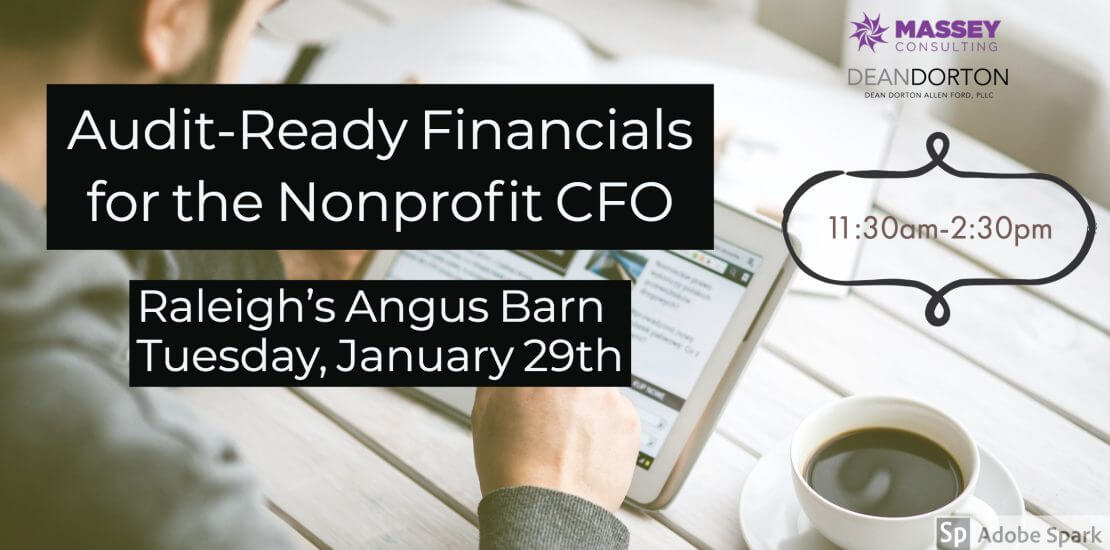

Learn how cloud financial management software can offer an efficient, paperless audit that saves both you and your auditor time and provides full transparency within your accounting system. Join us on Tuesday, January 29th, from 11:30 a.m. to 2:30 p.m. at the Angus Barn in Raleigh, North Carolina, for a presentation, Audit-Ready Financials for the Nonprofit CFO.

Attendees will qualify for 1.5 CPE credit hours, and a complimentary lunch will be served for all individuals who play a financial role in their organization—including CEOs and presidents.