This time of year, 1099 processes can be a daunting task. Luckily, Sage Intacct automates the process of generating and printing 1099s based on your vendor/employee and transaction setup. Connect vendors/employees to bills, generate a report to verify the results, then print your forms.

Things to Know

- There are two configuration options for 1099 transaction tagging depending on requirements and processes in your company.

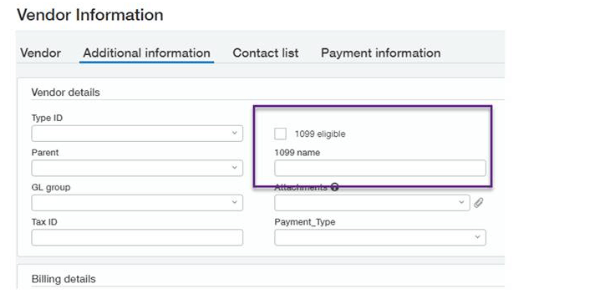

- Sage Intacct offers the ability to track 1099 Vendors and/or Employees.

- You can tag and have Intacct track totals for printing on your 1099 forms.

- After you’ve tagged them with a 1099 status, each transaction that you create against that vendor/employee displays the selected 1099 form type and 1099 box per line item.

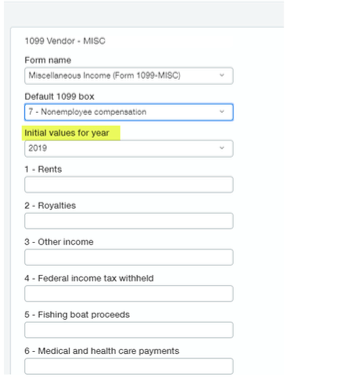

- Sage Intacct offers the ability to import or enter historical amounts if setting up a vendor/employee mid-year or for prior years.

Visit formsforintacct.com to order compatible 1099 forms.

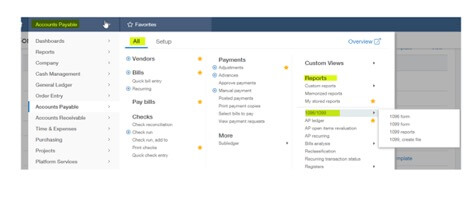

- You will preview the 1099 report to verify that you’ve setup vendors or employees with the correct 1099 form and review the amounts paid for a specific year.

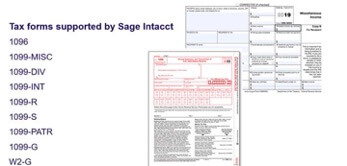

- Then generate the 1099 report and print your 1099 and 1096 forms to submit to the government.

- Don’t forget to change the year before printing the forms!

- Optionally, contact one of our Sage Intacct Marketplace partner services, which specialize in printing, mailing and filing 1099 forms electronically.

- You’ll need to create a 1099 file and export it, then upload it with one of the Marketplace partners.

More 1099 Tips

- If the vendor’s total 1099-MISC amount is less than $600 (2019 government guidelines), Sage Intacct will not generate a 1099 for that vendor.

- 1099 amounts show in the year that the bill is paid. So for example if you pay a vendor in 2019 for a bill in 2018, the payment amount will be on the 2019 Form 1099.

- The Sage Intacct Learning Center provides instructional videos and eLearning courses pertaining to Accounts Payable and 1099s

- Search our Sage Intacct Community for knowledgebase articles, 1099 on-demand webinar recordings, and FAQs

- The Sage Intacct Help Center provides multiple 1099 how-to and troubleshooting topics

You can learn more about Sage Intacct by visiting us here!