As a result of FASB’s project to enhance the usability of Not-for-Profit (NFP) entities financial statements and the associated notes to those financial statements, FASB released ASU 2016-14, Not-for-Profit Entities (Topic 958): Presentation of Financial Statements of Not-for-Profit Entities.

This update seeks to:

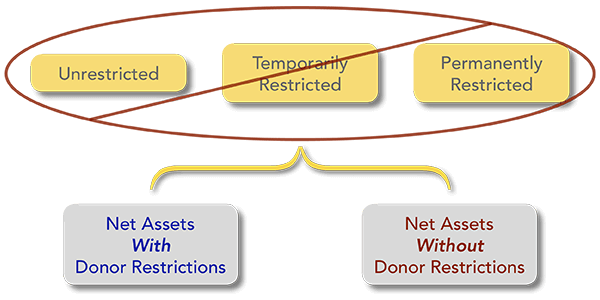

- Address the complexity of the three net asset classes

- Improve transparency in relation to liquidity issues

- Create consistent guidelines for the presentation and disclosure of expenses

- Simplify the statement of cash flow presentation requirements.

The current net asset classifications have been eliminated and replaced by two new classes:

Investment returns will now be presented net of expenses and the requirement to disclose those netted expenses has been eliminated. NFP entities using the direct method cash flow statements are no longer required to reconcile the direct method to the indirect method. For gifts received to acquire or build long-lived assets, entities will now be required to use the “Placed-in-Service” method to report the expiration of gift restrictions and will need to reclassify any such amounts for assets previously placed in service. The new guidelines require NFPs to present both the natural and functional classification of expenses in the same location.

Additional disclosure requirements are as follows:

- Disclosure of the amounts and purposes of self-imposed restrictions or limitations on assets without donor imposed restrictions.

- Disclosures of the composition of donor restricted net assets and how those restrictions affect their use.

- Qualitative information on management’s plan to meet the entity’s cash flow needs for the next twelve months as well as the availability of the assets that will be used to meet those needs.

- Disclosure of the methodology used to allocate expenses between program and support functions.

- Underwater endowment funds will now require increased disclosure requirements relating to the entity’s policies and actions taken concerning appropriation of such funds, the fair value of the funds, original gift amount to be maintained and the aggregate deficiencies of the funds, which are to be classified as part of net assets with donor restrictions.

Nonprofit organizations that will be affected include charities, foundations, colleges and universities, healthcare providers, religious organizations, trade associations, and cultural institutions, among others.

These changes will be effective for annual statements with fiscal years beginning after December 15, 2017 and for interim periods with fiscal years beginning after December 15, 2018. The amendment is to be applied on a retrospective basis; however, entities presenting comparative statements have the option to omit the increased requirements surrounding the analysis of expenses and liquidity and availability of resources for the period presented prior to adoption.

Authored by Tom Smither, Supervisor of Assurance Services.

For additional information, please contact your Dean Dorton advisor or:

Crissy Fiscus, cfiscus@deandorton.com

David Richard, drichard@deandorton.com