Here are the key risks and opportunities for 2019:

Attracting and Retaining a Quality Workforce

Productivity challenges exist when a manufacturer can’t retain a consistent workforce. Manufacturing companies today have a hard time finding employees who will show up and be on time for work and stick with their jobs. When it’s hard to find reliable personnel, employers have to spend excess time hiring and training new employees, then rehiring and training new employees. While manufacturing firms are doing what they can to inspire a new generation of manufacturing employees and experts, there is still a considerable void when it comes to skills and experience. Manufacturers need to work with schools and universities in their communities to ensure that manufacturing focused subjects are being well promoted and taught. In addition, manufacturers need to bridge the gap by encouraging their older employees to gradually slow down to retirement, passing on valuable skills to younger employees during a transition phase. Manufactures need to prepare for a wave of retirements in the next 10 years.

Cybersecurity

Manufacturers need to be proactive in cybersecurity by implementing effective controls to prevent and detect cyber-crime. Education of employees of potential phishing schemes is paramount to a successful cybersecurity campaign. Potential effects of a network infiltration include shut down of operations, theft of sensitive customer information, or theft of sensitive banking information.

Big Data Management and IT Infrastructure

Manufacturing involves a great deal of data and reliance on IT systems. Many companies are unsure of how to access and use that data to leverage positioning within a competitive market. In order for manufacturers to leverage their data properly, they must study data management opportunities and challenges, identify data management abilities, and prioritize data analysis plans. Additionally, manufacturers need to do an IT assessment to determine if investments need to be made to advance the company through more effective systems that facilitate data analysis. Additionally, controls need to be established around the use of artificial intelligence.

Product Development and Innovation

All manufacturers are cost conscious but should not miss out on well supported R&D opportunities. The global marketplace puts an emphasis on product development and innovation. Focus is needed to manage the innovation process and allow for a good flow of new product ideas and innovations to enhance future success.

Regulation Compliance and Traceability

The manufacturing sector faces increasing regulation and compliance measures. Inconsistent regulations from state to state and country to country present competitive challenges. Manufacturers must have complete visibility throughout their supply chain for their own compliance and that of their suppliers. Compliance can include everything from product safety to IT security to fair competition. Revenue and lease accounting standards are changing and impacting manufactures’ financial statements in 2018-2020 as well. Identifying a complete population of all leases under the new standard presents significant challenges to all businesses.

Safety, Including Overtime Management

Safety is a major concern for manufacturers as their employees routinely work around heavy equipment. Poor equipment maintenance can cause health and safety issues, as well as cause unplanned or excessive downtime. Manufacturers need to perform preventive maintenance on recommended schedules to keep operating costs low and throughput high while helping to ensure worker safety. Additionally, the monitoring of overtime hours to help protect the safety of employees represents an important oversight role and a vital way to control costs.

Embracing the Tax Cuts and Jobs Act

American manufactures should benefit from lower income tax rates which afford manufactures the opportunity to invest back into their businesses. Owners may also look at stock buyback opportunities. The new tax act allows for 100% bonus depreciation for five years which encourages capital investment. Manufactures may be able to improve employee benefit packages as well to help retain key employees. Lastly, manufactures should look to move business back to the U.S. from foreign locations to take advantage of the better tax landscape.

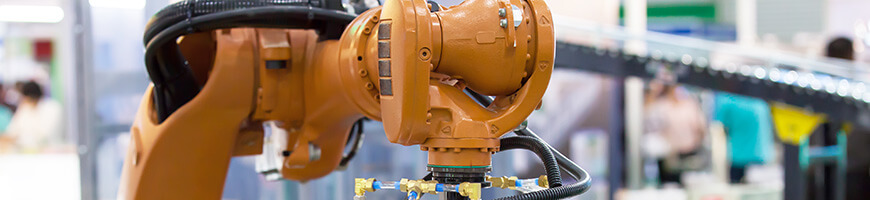

Robotics and Automation

(International Federation of Robotics; Robotic Industries Association)

Advancements in technology have afforded manufactures new tools that will alleviate some of the labor challenges. Manufactures have begun to use autonomous vehicles in warehouses to move materials and product. The nation is facing a shortage of truck drivers so the opportunity to use autonomous trucks could be accelerated as well. Robot orders indicate high interest in the automobile industry, electrical/electronics industry and metals industry. Experts proclaim that robots will change the economics of manufacturing with less time focused on low cost labor positions. Robots are becoming lighter and less expansive which increases the potential applications. Robots also offer the opportunity to be repurposed for multiple tasks. The average global robot density is about 74 industrial robots installed per 10,000 employees in the manufacturing industry in 2016. The most automated countries in the world are Republic of Korea, Singapore, Germany and Japan. Smarter robots with a “brain” in the cloud as a basis will benefit from big data and collective learning. Robots improve the quality of work by taking on dangerous, tedious and dirty jobs that are not possible or safe for humans to perform. By 2020 it is estimated that approximately 3 million robots will be operational on a global basis. In 2010 only 1 million robots were operational. Global sales of industrial robots reached a record 387,000 units in 2017 (31% increase). China saw the largest increase at 58% while USA increased 6%.

Culture

The culture at the company may not embrace change which puts the manufacturer at a competitive disadvantage. Additionally, the tone at the top needs to be positive and sensitive to conducting ethical business.

Tariffs

Significant tariffs have emerged during 2018 which impact imported materials including aluminum and steel. Companies will need to work closely with its vendors to understand any expected cost increases and the possibility of having to look for alternative vendors due to pricing pressure or the viability of the existing vendor. The expected cost increase will need to be negated by a focus on after sales service, improved focus on maintenance to keep equipment operating efficiently and enhanced service part management that integrates ERP systems with vendors.

Sources: International Federation of Robotics, Robotic Industries Association, National Association of Manufacturers Outlook Survey